2025 Taxation Information

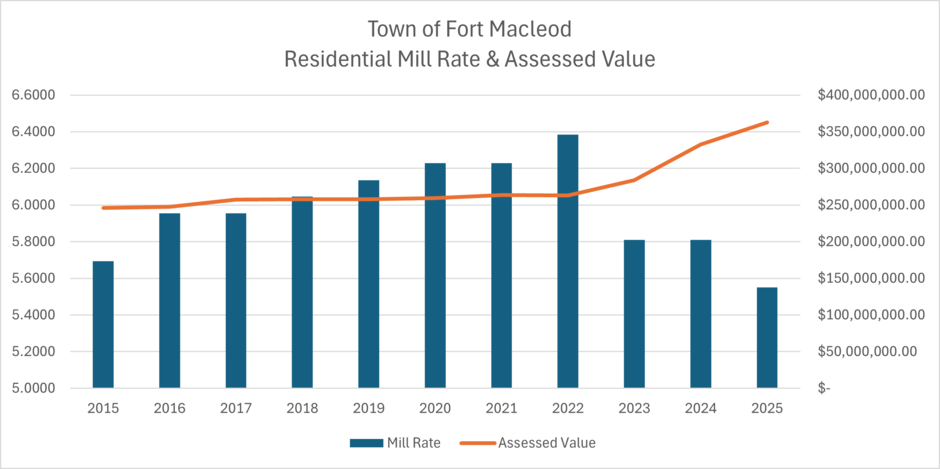

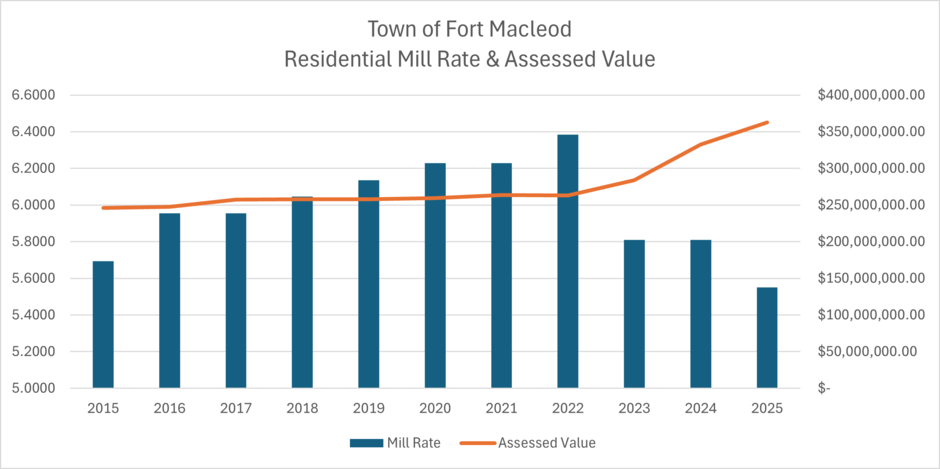

Did You Know? Fort Macleod has one of our region's lowest residential property tax rates!

Among Alberta towns with populations under 10,000, Fort Macleod ranks among the most affordable for residential municipal taxation. The average residential mill rate across comparable towns is 7.22; we’re proud to be well below that.

- The Province of Alberta (Education Property Tax)

- The Willow Creek Foundation (Seniors Housing)

-

Emergency services and bylaw enforcement

-

Road maintenance and snow removal

-

Recreation facilities and community programming

-

Economic development and planning

-

Parks, trails, and green spaces

Questions about your property assessment?

If you have concerns about the assessed value of your property, you can contact Lance Wehlage at Benchmark Assessment Consultants to discuss it directly.

If you're unable to come to an agreement with the assessor, you have the right to file an appeal with the Assessment Review Board.

All the details on how to do this are included below.

If you have any questions about your tax notice, feel free to contact the Town Office at 403-553-4425, or email txclerk@fortmacleod.com

Paying Your Taxes

Combined assessment and property tax notices are sent out by the end of May each year. Taxes are due on the last business day of June at 4:30 pm.

2025: Deadline is Monday, June 30, 2025 at 4:30 pm

Read the back of your notice for all the payment options available to property owners.

If you do not pay your property taxes in full by the deadline, the Town will assess a penalty on your tax account per the Tax Penalty bylaw.

PAYMENT METHODS

Important! CREDIT CARD payments are NOT ACCEPTED for tax payments.

DEBIT, CASH, CHEQUE: (Payable to "Town of Fort Macleod" Postdated cheques are accepted).

IN PERSON: at the Town of Fort Macleod office, Monday through Friday, 8:30 a.m. to 4:30 p.m. (GR Davis Administration Building, 410 20th Street, Fort Macleod).

EXTERNAL SECURE DROP BOX: by front doors available 24 hours, 7 days/week. Please include the bottom portion of the tax notice with your payment **If using the Drop Box Method, payment MUST be in the box BEFORE 4:30 pm on the DUE DATE.

BY MAIL: Town of Fort Macleod, Box 1420, Fort Macleod, AB T0L 0Z0. MUST be postmarked by the due date.

ONLINE BANKING: Offered through ATB, BMO, C1CU, CIBC, RBC, SCOTIA, & TD. Select the Payee: Town of Fort Macleod Tax, and enter 7 DIGIT TAX ROLL NUMBER (as listed on the Tax Notice) MUST be posted by the due date.

Every year combined property assessment and tax notices are sent to property owners before the end of May. Taxes are due by the end of the last business day in June each year. The deadline to appeal your property's assessed value is 60 days after the date of mailing of the notices. Please read your combined notice and all inserts carefully to get information on methods of payment, appealing your assessment, and penalty dates.

The Town of Fort Macleod contracts our assessment services to Benchmark Assessment Consultants Inc. For questions on your assessment please contact the Town's assessor, Lance Wehlage, at Benchmark Assessment Consultants Inc. at 403-381-0535 or lance@benchmarkassessment.ca.

Property Assessment Information for the General Public: Follow this link Assessment Information

or review the Town's Assessment Roll for 2025 taxation.

Your tax notice shows how your taxes pay the following:

- the Town of Fort Macleod for operational needs,

- the Government of Alberta for their education requisition

- the Willow Creek Foundation for their seniors housing requisition

So not all the money that comes into the Town of Fort Macleod is ours. We pay requisitions for both education and seniors housing out of your payment.

The money that stays with the Town pays for a wide variety of services including: fire, bylaw, road maintenance, snow removal, recreational amenities and programs, cultural programs, community events, development, economic development, the library, halls and so much more.

UNDERSTANDING YOUR COMBINED PROPERTY ASSESSMENT AND TAXATION NOTICE

Prior to filing a written complaint, taxpayers are encouraged to contact Benchmark Assessment Consultants Inc. The assessor can review your assessment with you. If the assessor determines an error has been made, your assessment will be revised.

If after talking with the assessor, you feel your concerns are not satisfied, you may file a formal complaint with the Assessment Review Board on or before the final date for complaint indicated on your assessment notice. A written complaint explaining why you feel your assessment is incorrect, along with the appropriate filing fee must be submitted to the Town of Fort Macleod. The information required to file a complaint, along with a fee schedule is stated on your assessment notice. Download the Assessment Review Board Complaint Form .

If you are appealing your assessment notice, your taxes must still be paid in full by the due date to avoid incurring penalties.

For more information about your property assessment, contact Lance Wehlage at Benchmark Assessments at 403-381-0535.

The Town of Fort Macleod's taxation year runs from January 1 through December 31st with property taxes being due in full on the last business day of June at 4:30 pm.

The Town offers a tax installment program where monthly installments are withdrawn from your bank account and applied toward your tax account so your balance is zero at the end of December.

For the first four (or five months) your payments build up a credit on your tax account. Then the new property taxes are assessed and billed and your tax account will show an amount owing. The Town continues to withdraw monthly payments towards your taxes owing so at the end of December your balance is zero. Then the entire process starts again.

For more information on this program please read the TIPS brochure 2025 Tips on TIPPS or contact the Taxation Clerk at the Town Office.

If you are interested in signing up for the TIPP please fill out the Tax Installment Payment Plan Application.

If you wish to terminate your automated monthly withdrawals through the TIPP program, please complete the TIPP Cancellation form.

For information about the Seniors Property Tax Deferral Program, contact Alberta Supports Contact Centre toll-free at 1-877-644-9992. Information can also be found online at www.seniors.alberta.ca/seniors/property-tax-deferral.html.

Your property's land title is a legal document. The mailing address that is on your land title is the address the Town uses to mail out your property tax notice each year. The Town will not change your mailing address until we formally receive a change notification from the Government of Alberta Land Titles Office for security reasons.

If you have changed your mailing address, you have a couple of options:

- You can fill out a Change of Address Form to change your mailing address with the Alberta Land Titles Office. Once they have made the change, they will notify the Town and we will update your mailing address. Please note you must put down your legal land description (lot, block and plan) and not your civic address on the form.

- You can fill out a ebilling form so that your tax notice is emailed to you each year.

If you do apply to the land title office to have your mailing address changed, in the interim while we wait for the request to be processed, please email the property tax roll number and the new mailing address to the Taxation Clerk so that we can ensure you don't miss the mailout of tax notices.

When a property's taxes go into arrears, the Town has the authority to recover the amounts through the tax recovery process which is legislated by the Government of Alberta. The following is the process the Town follows:

- Each year the Town MUST, not later than March 31, prepare a list of all parcels of land that are more than one year in arrears and forward to the Registrar at the Land Titles Office. A Tax Recovery Notification will be registered on the Certificate of Title.

- Once a Tax Recovery Notification has been endorsed on the Certificate of Title, the person who is liable to pay the taxes must not remove any improvements for which taxes can be levied and for which that person is responsible without the approval of the municipality.

- Anyone can pay the tax arrears owing against the property and the Town will discharge the Tax Recovery Notification.

- If the tax arrears are not paid by March 31 of the following year, the Town will offer the parcel for sale at public auction and may become the owner of the parcel if it is not sold at public auction.

- Section 326 (c) of the MGA defines “tax arrears” as “taxes that remain unpaid after December 31 of the year in which they are imposed.” Taxes are in arrears if they are unpaid as of January 1 of the year following the year in which they were imposed. Section 332 states that taxes imposed are deemed to have been imposed on January 1.

- Once the Registrar has endorsed the Tax Recovery Notification he or she must, not later than August 1, send a notice to the owner of the parcel of land, to any person who has an interest registered against the parcel, and to each owner of an encumbrance as shown on the Certificate of Title. The notice must state that if the tax arrears are not paid by March 31 of the following year the municipality will offer the parcel for sale at public auction, and the municipality may become the owner of the parcel if it is not sold at public auction.

- The Town MUST offer for sale at a public auction any lands with tax arrears that are shown on its tax arrears list.

- Discharge of Tax Recovery Notification will not be sent to Land Titles until the arrears and penalties are paid in full.

- The Town must establish a reserve selling price before it can auction a property. The reserve bid is set at a level that is as close as reasonably possible to the market value of the parcel.

- The Town must advertise the public auction in the Alberta Gazette and one local newspaper. The information in the advertisement must specify the date, time and location of the auction and a description of each parcel of land to be offered for sale. The advertisement must also include any terms and conditions of the sale.

If you have questions or concerns regarding the Town's tax recovery process, please contact the Tax Clerk or call the office at 403-553-4425.