Where does my tax dollar go?

Fort Macleod Residents & Businesses to Benefit from Reduced Mill Rates in 2023

Fort Macleod homeowners and business owners will be pleased to learn that there has been a historic reduction in their municipal property taxes in 2023. The Town Council has passed the first reading of the 2023 Mill Rate Bylaw, which includes a 9% reduction in the residential mill rate and a 10% reduction in the non-residential mill rate.

The reduction in mill rates comes at a time when property assessments in the area have significantly increased. On average, residential assessments have gone up by 15.9% and non-residential assessments by 16.6%. This historic increase is due to properties being sold at sales prices well above the amounts seen in the past.

The proposed 9% reduction in the municipal mill rate for residential properties would translate into an increase of $80.30 in municipal taxes for an average residential property valued at $266,570 in 2023. For an average non-residential property valued at $451,242, the proposed 10% reduction in the municipal mill rate would lead to an increase of $239.21 in municipal taxes.

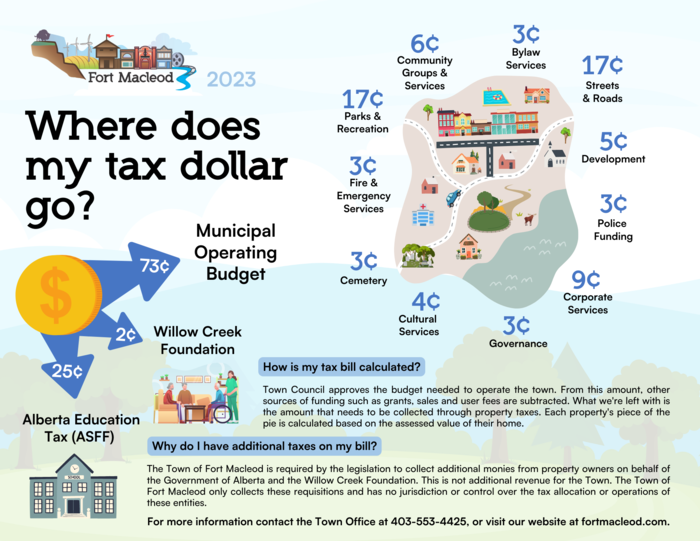

Fort Macleod's 2023 assessment and mill rate changes are set to impact property owners, but understanding how your tax bill is calculated is crucial in understanding these changes. The Town Council approves the budget needed to operate the town, and from this amount, other sources of funding, such as grants, sales, and user fees, are subtracted. The remaining amount needed to fund the budget is collected through property taxes.

Your tax bill is calculated based on the assessed value of your home, which is determined by the Town's assessor. It's important to note that the Town of Fort Macleod is required by legislation to collect additional taxes from property owners on behalf of the Government of Alberta (Education Tax and the Willow Creek Foundation). This is not additional revenue for the Town. The Town of Fort Macleod only collects these taxes and has no jurisdiction or control over the tax allocation or operations of these entities.

Combined assessment and property tax notices were sent out on April 26, 2023.

If residents feel that there is an error in their assessment, they can contact the Town's assessor, Lance Wehlage, at Benchmark Assessment Consultants Inc. at 403-381-0535 or by email at lance@benchmarkassessment.ca.

With the increase in property assessments, the proposed mill rate reductions will help to ease the municipal impact on property owners during this inflationary period. Fort Macleod continues to attract new residents and businesses as a growing and exciting town. For more information on assessments and property taxes, visit the Town of Fort Macleod's website at https://www.fortmacleod.com/live/town-services/taxation or call the Town Office at 403-553-4425.

Property tax payments are due June 30, 2023 at 4:30pm.