Public Hearing Notice: Proposed Bylaw 2005 Non-Residential Tax Incentives

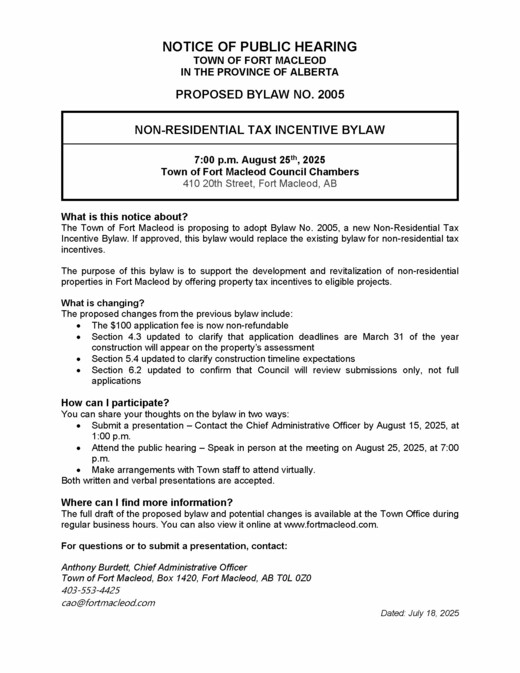

NOTICE OF PUBLIC HEARING

TOWN OF FORT MACLEOD

IN THE PROVINCE OF ALBERTA

PROPOSED BYLAW NO. 2005

|

NON-RESIDENTIAL TAX INCENTIVE BYLAW |

|

7:00 p.m. August 25th, 2025 Town of Fort Macleod Council Chambers 410 20th Street, Fort Macleod, AB |

What is this notice about?

The Town of Fort Macleod is proposing to adopt Bylaw No. 2005, a new Non-Residential Tax Incentive Bylaw. If approved, this bylaw would replace the existing bylaw for non-residential tax incentives.

The purpose of this bylaw is to support the development and revitalization of non-residential properties in Fort Macleod by offering property tax incentives to eligible projects.

What is changing?

The proposed changes from the previous bylaw include:

- The $100 application fee is now non-refundable

- Section 4.3 updated to clarify that application deadlines are March 31 of the year construction will appear on the property’s assessment

- Section 5.4 updated to clarify construction timeline expectations

- Section 6.2 updated to confirm that Council will review submissions only, not full applications

How can I participate?

You can share your thoughts on the bylaw in two ways:

- Submit a presentation – Contact the Chief Administrative Officer by August 15, 2025, at 1:00 p.m.

- Attend the public hearing – Speak in person at the meeting on August 25, 2025, at 7:00 p.m.

- Make arrangements with Town staff to attend virtually.

Both written and verbal presentations are accepted.

Where can I find more information?

The full draft of the proposed bylaw and potential changes is available at the Town Office during regular business hours. You can also view it online here:

Draft Bylaw 2005: Non-Residential Tax Incentives

For questions or to submit a presentation, contact:

Anthony Burdett, Chief Administrative Officer

Town of Fort Macleod, Box 1420, Fort Macleod, AB T0L 0Z0

403-553-4425

cao@fortmacleod.com

Dated: July 18, 2025