2025 Property Tax Notices & Mill Rate Update

Did You Know? Fort Macleod has one of our region's lowest residential property tax rates!

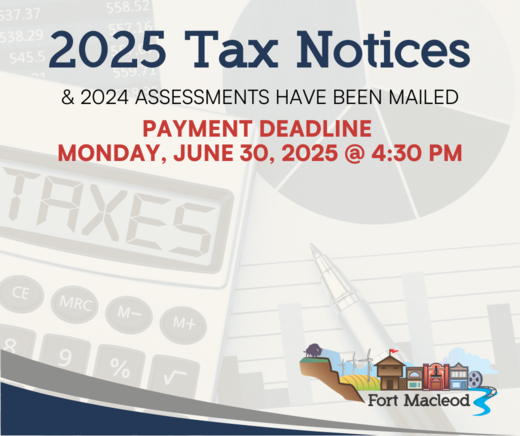

Your 2025 property tax notice, based on your 2024 property assessment, has now been mailed.

As part of Council’s ongoing commitment to fiscal responsibility and transparency, we’re pleased to share some good news: Council has decreased the residential mill rate from 5.81 to 5.55.

This decision was made to offset increases in assessed property values and minimize the financial impact on our residents, while continuing to deliver the high-quality services our community relies on.

Residential Property Tax – How We Compare

Among Alberta towns with populations under 10,000, Fort Macleod ranks among the most affordable for residential municipal taxation. The average residential mill rate across comparable towns is 7.22; we’re proud to be well below that.

Among Alberta towns with populations under 10,000, Fort Macleod ranks among the most affordable for residential municipal taxation. The average residential mill rate across comparable towns is 7.22; we’re proud to be well below that.

Business (Non-Residential) Property Tax – Also Competitive

In addition to reducing the residential rate, Fort Macleod’s 2025 non-residential (business) mill rate is 11.71, compared to the average of 14.37 for Alberta municipalities. This keeps Fort Macleod competitive and appealing for local businesses and new investments.

Understanding Your Tax Bill

If you’ve noticed an increase in your total property tax bill, it may not be solely due to municipal taxes. Your tax bill includes other requisitions that the Town is required to collect on behalf of external organizations, such as:

- The Province of Alberta (Education Property Tax)

- The Willow Creek Foundation (Seniors Housing)

These amounts are set by their respective governing bodies, and the Town has no control over these rates. Only the municipal portion, Fort Macleod's rate, is set by your Town Council.

What Your Municipal Taxes Support

Your municipal taxes go directly toward services like:

-

Emergency services and bylaw enforcement

-

Road maintenance and snow removal

-

Recreation facilities and community programming

-

Economic development and planning

-

Parks, trails, and green spaces

We’re proud to maintain strong services while keeping our tax rates among the most competitive in Alberta.

Check out the comparison chart here:

Questions about your property assessment?

If you have concerns about the assessed value of your property, you can contact Lane Wehlage at Benchmark Assessment Consultants to discuss it directly.

If you're unable to come to an agreement with the assessor, you have the right to file an appeal with the Assessment Review Board.

All the details on how to do this are included in the insert that came with your tax notice.

If you have any questions about your tax notice, feel free to contact the Town Office at 403-553-4425, email txclerk@fortmacleod.com or visit our taxation page on our website: https://www.fortmacleod.com/live/town-services/taxation